Make a lending decision

Follow the loan qualification demo app end-to-end to start an application, analyze it, and make a decision on the loan request

🚀 In this section, you will...

- Review the basic process flow followed by the demo app,

- Create a new loan application,

- Create a Codat company and connect it to the Codat Sandbox,

- Fetch financial data to assess the applicant's financial health,

- Categorize accounts that were omitted by Lending, and

- Receive a decision on the loan.

This diagram shows the steps of the loan qualification process as performed by the demo app. It helps you visualize the relationship and information exchange between the app's different components.

You can also review the detailed technical diagram of the flow that the demo app follows.

Start a new loan application

🙏🏽 This step is normally performed by the borrower.

We use Swagger to act as a presentation layer to interact with the demo endpoints. There are three endpoints that support the creation and processing of the application form, and three endpoints to interact with webhook rules you have previously set up. Remember to click Try it out and Execute when working with Swagger.

Call the /applications/start endpoint to trigger the creation of a new loan application. In the background, the app creates a company using Codat's POST /companies endpoint using the application id as the company name.

Codat returns the company and application ids in the endpoint response together with a linkUrl. In the demo, we will use these elements to fill in the application details and connect a data source next.

{

"id": "1c727866-6923-4f81-aa7b-c7fd8c533586",

"codatCompanyId": "a9e28b79-6a98-4190-948d-3bd4d60e7c0a",

"status": "Started",

"linkUrl": "https://link.codat.io/company/a9e28b79-6a98-4190-948d-3bd4d60e7c0a"

}

Provide application details

🙏🏽 This step is normally performed by the borrower.

Once you receive the application id, complete the application form using the /applications/{applicationId}/form endpoint. In our demo, we request the applicant's full name, company name, and the loan amount, length, and purpose. If the details provided are valid, they are stored against the application id with an acknowledgment of their receipt.

{

"id": "applicationId",

"companyName": "Example Company",

"fullName": "John Smith",

"loanAmount": 25000.00, // must be greater than zero

"loanTerm": 36, // must be at least 12 months

"loanPurpose": "Growth marketing campaign"

}

Share financial data

🙏🏽 This step is normally performed by the borrower.

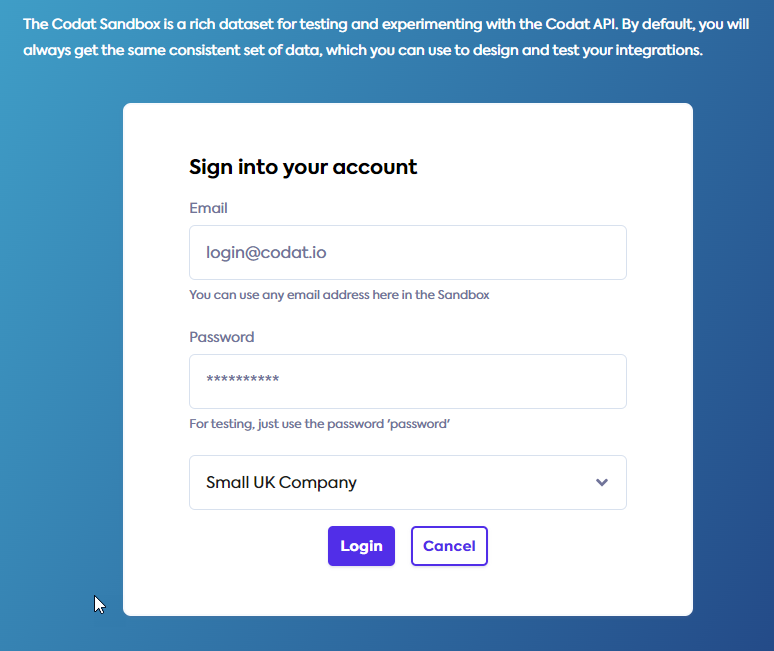

Next, you need to provide Codat access to an accounting platform so that we can fetch the data required to underwrite the application. Open the linkUrl returned by the new application response in your browser window. Follow the flow built using Link, our hosted or embedded integrated authorization flow.

Select the Codat Sandbox as the source of accounting data.

- You can choose any company type that best fits your use case.

- You don't need to enter any credentials to authorize this connection.

- You should also skip the step of uploading business documents.

Check categorized accounts

💰 This step is normally performed by the lender.

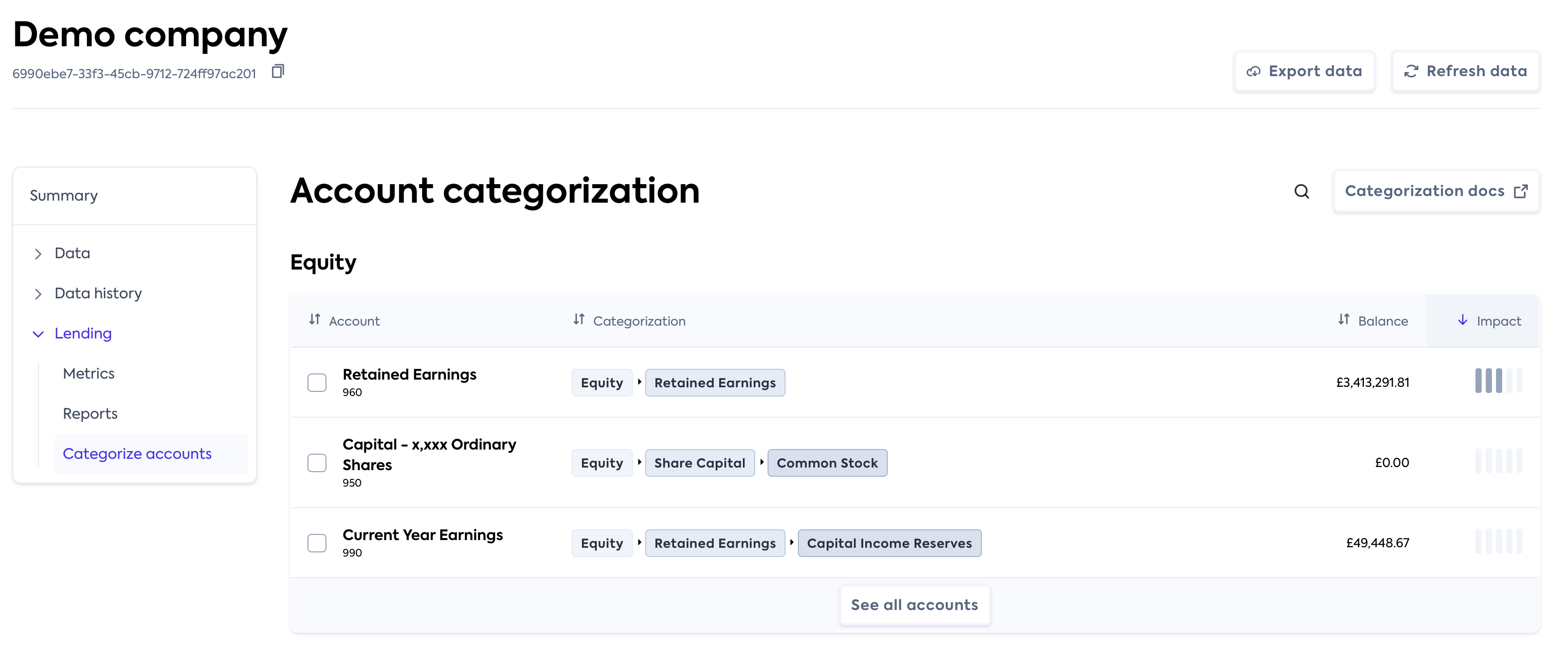

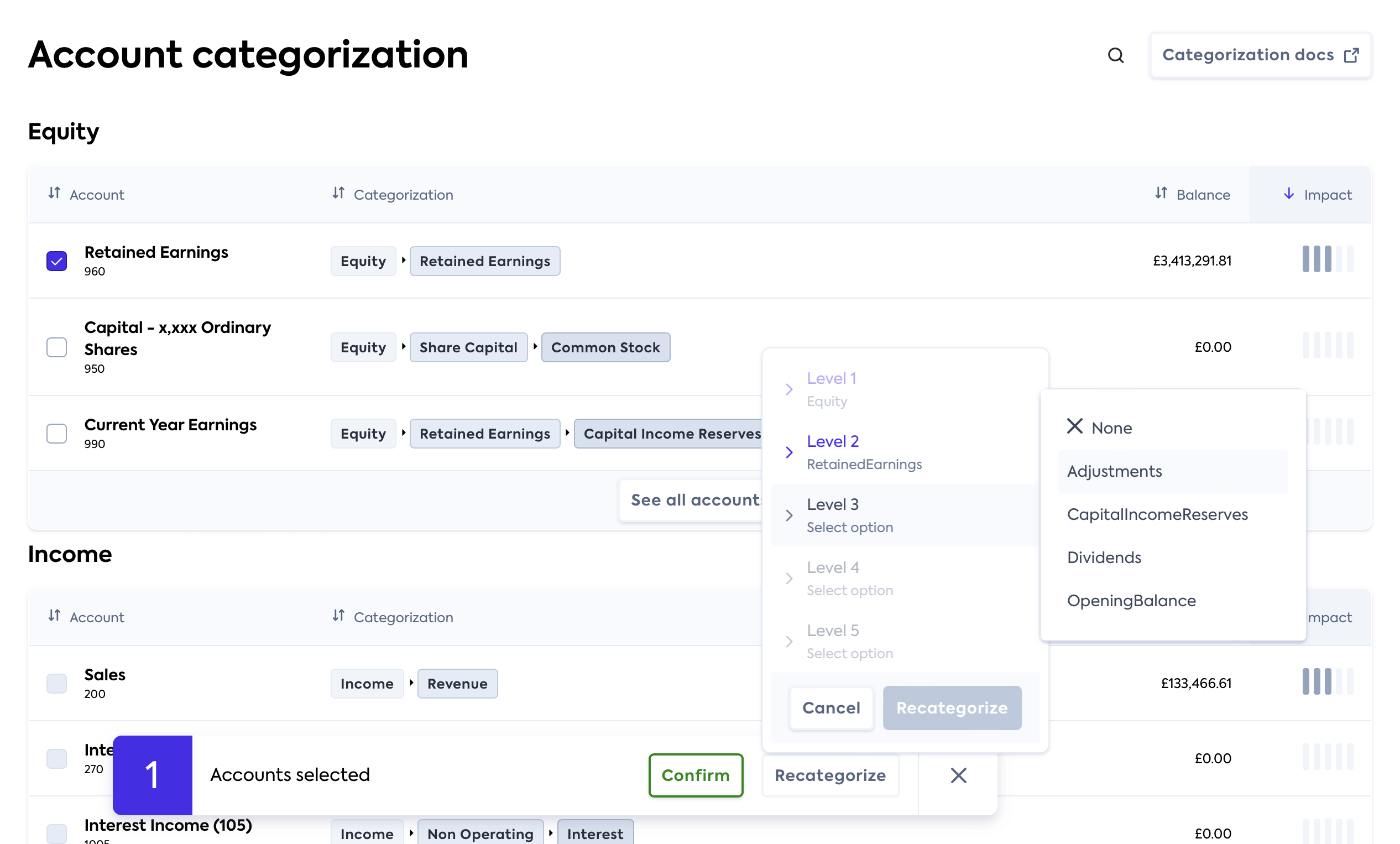

The demo app makes use of the categorization feature of Lending API. When fetching financial data, Codat’s Lending product analyses the full list of a company's accounts and assigns a category to each account. While it is able to automatically categorize most of the source accounts, it is not always possible, and manual intervention may be required.

In our demo, all accounts are successfully categorized. However, your underwriter may want to review the suggested categories before continuing on with the assessment. This can be done on the Companies page of the Portal. Click on the company you are performing loan qualification for, and navigate to Lending > Categorize accounts.

This takes you to the Account categorization page which displays the categorized accounts. Check that you are happy with Codat's suggestions or override a suggestion by selecting the account's checkbox and clicking Recategorize.

Make the decision on the loan

🙏🏽💰 The decisioning is normally performed by the lender, but the borrower is able to query an application's status at any point.

The demo app now has all the components that it needs to produce a loan qualification decision. The decision is automatically made by the

LoanUnderwriter service based on thresholds that need to be passed by the applicant. We then update the loan application with a relevant status to indicate the decision made on the loan or any errors that occurred in the process. You can poll the GET applications/{applicationId} endpoint in Swagger anytime to check the status of your loan.

💪 Ready for more?

Try these suggestions to make the most of your experience with the demo app:

View Lending API in the Portal

Navigate to Products > Lending in the Portal to view a visual representation of the financial data pulled by our endpoints, includingbalanceSheetandprofitAndLoss.Play around with thresholds

In theappsettings.jsonfile in theCodat.Demos.Underwriting.Api\directory, set your own example thresholds for data points used by the app's loan qualification service and see how this affects the application decision.Underwrite using different datasets

Start another loan application, and choose a different Sandbox company type to get a different set of financial data to be used in the decision-making.Use a company's real data

Take the demo one step further and use real credentials to access existing financial data in an accounting platform. Set up the integration you plan to use, and connect to it while following the auth flow. Then, review how the app makes a decision based on your company's real data.Inspect the loan qualification logic

We provide detailed information about the loan qualification logic we included in our demo app, and how exactly the financial data is fetched.

Recap

You have now successfully run the demo app, covering all the key loan qualification process steps. You have started and completed an application, connected and fetched accounting data, and received a decision on your loan application.